Monthly Update January

Positive trading updates boosted the funds

- Dovish signals from Trump pushed markets to new all-time-highs

- Positive trading updates from several portfolio companies

- Geopolitical turbulence could create opportunities

ORIGO SELEQT

Seleqt rose by 5.5% during the month. The fund's benchmark rose at the same time by 5.2%. In the last 12 months, the fund has thus returned 26.1% and the benchmark 16.9%.

Invisio became "company of the month" after a positive trading update and a 20% share price increase. SOBI (releasing a positive trading update aswell) and Elekta also contributed very well. Among the fund's smaller holdings, BIM Object stood out with an increase of almost 30%. No company made a major negative contribution.

Backed by our proven analysis model, we have identified several new investment ideas for 2025–2027; Quality companies that are undervalued and facing a positive and often under-discounted operational change. The biggest investments in recent months are Ringkjoebing Landbobank, Carasent and Europris. Financing of these has been done by, among other things, selling off Spar Nord after the takeover bid in December.

The combination of our own in-depth analysis in the entire Nordic small company universe and a focused management with +92% Active Share has created very competitive returns in Seleqt since inception. The valuation, the interest rates and the profit development suggest that we are only at the beginning of a new and longer period of excess returns for the small cap segment.

ORIGO QUEST

Quest returned 0.3% during the month, which means a return of 15.1% in the last 12 months and approximately 9% in annual return since 2013.

The long book paid well, with Invisio, SOBI and Elekta contributing the most. Among the smaller positions, BIM Object and Dynavox had strong development. The short book had a negative return as a whole, but no individual company stood out.

The short book is structured around companies where we see red flags. Usually, it is firms we believe the accounting is problematic in or that the balance sheet and cash flow indicate a different development than that required to defend the share price.

Evolution is a major short position in the fund and was so through 2024. It has been a strong contributor to the short book after falling nearly 30% over the past 12 months. We note the following problematic factors and red flags:

- Economic headwinds for the industry, marketing and growth are slowing down

- Increased reliance on unregulated high-risk markets in Asia and Eastern Europe to maintain growth and high margins

- The growth comes partly from operators that lack a license and from operators that are growing strongly as they have little focus on AML as they are so-called crypto-casinos.

- Unclear how many end customers there are on unauthorized markets

- Difficulties in dealing with distributors who sell on to unauthorized markets

- Internal conflicts and strikes at Evolution

- Ongoing regulatory matters at the British Gambling Authority and Swedish FI and CFO's dismissal while in these processes

- The buy case is based on Evolution being a cheap stock and they are growing and generating strong cash flows, while there is great uncertainty about where revenues and margins would be if the company were to exclude operators that operate without a license, unregulated high-risk markets and unauthorized markets.

- In the Q4 report, EVO lowered its margin assumptions for 2025 and gave as the reason that it tries to screen off regulated markets and ensure that Evolution's products are only allowed in local licensed B2C operators where local licenses are possible.

Sometimes we are asked if we have too high goals, i.e. to continue delivering in line with the historical result of 9% per year. It is a legitimate question. The fund's strategy is to deliver equity-like returns but with a lower and more bond-like risk level. In addition, we have indicated to our investors that we want the fund to have a low correlation to the stock market, which makes the fund very interesting from a diversification perspective in a larger portfolio. But is it reasonable to create excess returns over time without taking risk and also without the undesirable correlation?

The answer is both Yes and No.

Firstly, Quest takes risk, but we essentially try to stick to what is known as unsystematic risk, or company-specific risk. This risk is unique to each company and can be minimized through diversification. We put all our resources into the company analysis and have over 200 company meetings per year. We often meet both management, the largest owners and competitors before we have an investment thesis on the table.

The other major risk factor is the systematic risk, also called the market risk or Beta, and it is entirely a result of external factors. A long equity fund cannot diversify away this significant risk, but a hedge fund like Quest can, as the strategy is more flexible and allows for shorting and short derivative positions. If this is done successfully, the sum of the above results is a clearly lower Total Risk.

Quest thus takes risk, but in principle only non-systematic. It also means that the fund is not an equity fund but an alternative fund with completely different characteristics. A fund where the return generated from the company selection and not from external factors such as political developments, interest rate movements, changes in risk appetite or simply from the general trend of the market.

At the same time, we can state that the model has worked very well for Quest. The annual return amounts to a "share-like" 9%. The risk level has been clearly lower than the stock market and the correlation limited. Last year the return amounted to 15.1% while the Beta was zero, which means that the fluctuations of the market did NOT affect Quest at all.

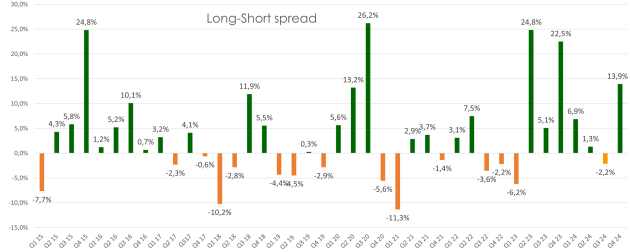

Perhaps the purest metric for evaluating value creation in our hedge fund is the long/short spread – and to what extent the long book has outperformed the short book. The chart below shows that total returns have averaged 3.6% (gross) per quarter since 2015, which is very competitive by almost any comparison. It can also be seen that the number of positive quarters exceeds the negative ones.

For those investors looking for diversification that does not contain uncontrollable stock correlation, we can therefore, backed by twelve years of history, recommend Quest!

MARKETS

After the weak December market, where it began to hesitate about future interest rate cuts, the global stock market has gained new momentum upwards. There has been a huge focus on a certain president and all his antics.

Wall Street has (unlike traditional media) picked up on the fact that Trump has been clearly more dovish on tariffs and China than he was last fall. From having then threatened tariffs of 60% to China, he suddenly talked about 10% before Christmas. In January, he toned down the message further. "We have a lot of leverage over China through tariffs, and they don't want them, and I would prefer not to introduce them." The S&P500 reacted positively, hitting a new all-time high in the middle of the month.

At the end of the month, however, there was a real AI frenzy after the Chinese start-up Deep Seek had launched its new AI Chat bot. According to questionable sources, it was developed at a fraction of the cost of its competitors and without access to the extremely expensive NVIDIA chips. In just one week, Deep Seek became the most downloaded free app in the US. Deep Seek works in the same way as ChatGPT, but it is now time to deliver. The model behind Deep Seek, called R1, has around 670 billion parameters, making it the largest open-source model to date. The launch and all the uproar around it pushed back the technology companies in the US and not least Nvidia, which lost over 15% or 450 billion dollars of market capitalization in one day.

What is now happening in Nvidia and some other American technology companies should not really be surprising to anyone, even if it came as a shock to many. Extreme excess profitability and even more extreme multiple expansion cannot last for any length of time.

”What goes up must come down”

/Isaac Newton, scientist and mathematician

INVESTMENTS IN FOCUS

Invisio recently released preliminary Q4 sales figures that were 30% higher than the most optimistic forecasts. The stock rallied roughly 20% on the news, and now we look forward to more information when the quarterly report arrives on February 13. We will focus on the development of the order book and how the product mix develops. The company has had a very strong development for a long time and the analysts have almost constantly underestimated the growth rate and margins. From having grown by 60% in 2023 and 35% in 2024, the consensus seems estimates are around 10% for 2025... That would mean a real slowdown, which we currently have a very hard time seeing given the need for more modern and safer communication equipment in the growth industries that Invisio faces.

PS: Origo started investing in Invisio at the end of 2013 and became one of the 10 largest owners via a directed issue of SEK 4.40 per share. The market value was SEK 185 million and the company's revenue amounted to SEK 85 million and the result was negative. Today, Invisio has a turnover of SEK 1.7 billion and a profit margin of over 20%. The market capitalization amounts to SEK 14 billion and it has net cash of SEK 300 million. A fantastic performance (!) by CEO Lars Hoejgård Hansen and by former major owner Lage Jonason to name a few. With approximately 70X invested capital in return, Invisio is our best investment - so far.

Ringkjoebing Landbobank (RILBA), one of Denmark's oldest banks, which was founded back in 1886. In Denmark, there are about a hundred independent small banks, of which about 15 are listed on the stock exchange. But they have been decreasing in numbers since a while back as the consolidation is in full swing. RILBA is one of the absolute most profitable and efficient banks in the Nordics and Europe. The company has taken market share organically, and through 3 acquisitions since 2018. Organically, RILBA has grown approximately 7 percentage points more than the Danish loan market has done, and we believe this can continue even if the market returns cyclically after a few tougher years.

In Jutland, they have an enormously strong market share and the K/I ratio has historically been around 0.25–0.3, which is world class.

We also note that the quality is seen in which customer segments the bank is strong in and in how they look after its balance sheet and its shareholders. The return on equity is stable above 20%, a dream level for many banks. An important value driver going forward is the optimization of the balance sheet. RILBA has been an active buyer of its own shares and has just announced that it is launching a new buyback program of half a billion Danish kroner. The P/E ratio of 12X is in the lower part of the historical range of 11-18X even though the ROE is higher as the market has been worried about the net interest going down for banks in general and also for RILBA. We noted that RILBA had lower sensitivity in net interest when interest rates rose and believe that it will be lower when interest rates fall and therefore think that generally accelerating growth and a P/E ratio in the lower part of its history is interesting. We are buyers.

The Norwegian salmon sector has gradually recovered from the big tax shock in 2022, but 2024 was also a challenging year when volumes were not as expected. Now we see some signs that demand is starting to increase again, especially in the US, and that the cost increases for feed seem to be more under control. At the same time, low volume growth usually leads to better prices, so we note that the overall picture is not so bad. Slightly better volumes, cautiously rising salmon prices, in combination with cost control, may drive up the operating margins more than the stock market is currently discounting in the salmon companies' prices.

We will also keep an eye on the Norwegian parliamentary elections in September. If a right-wing government wins then has Erna Solberg already been out talking about lowering the tax on salmon farming from 25% to 15%.

We built a position in Bakkafrost October 2022 after the big salmon run and have had around 40% total return since then. It's not a shame, but still clearly less than what our analysis indicated. Possibly, the above triggers, together with the operational improvement work underway in Bakka, can contribute to a reassessment.

Best regards,

Team Origo

Risk Information

Past performance is not a guarantee of future returns. If you invest in securities or funds, your investment can both increase or decrease in value, and it is not certain that you will get back the entire invested capital. An investment in our funds should be viewed as a long-term investment.

Table 1: Origo Quest, Long/Short spread