Reports

2024

- September surprised positively after significant stimulus

- Elekta - time for change

- Origo Seleqt: +31% (12m)

Origo Seleqt

Seleqt lost 0.5% during the month while the market (VINX Small Cap) rose 0.1%. Last year, the fund rose by 31%, which is 3 percentage points better than the index. Hanza and Bilia had a negative impact. Paradox, Kalmar (new investment) and Elekta made positive contributions.

During the summer, the forklift manufacturer Kalmar was listed on the stock exchange, after being spun off from Finnish Cargotec. We have followed the company for a long time, both during Cargotec's ownership and during the period before when Kalmar was its own company on the Stockholm Stock Exchange. The company has a strong position globally, profitability is good and it has a well-developed service business. We think the valuation is very attractive and expect a revaluation as the transport industry stabilizes.

Origo Quest

The hedge fund Quest lost 1.5% during the month, and has risen by just over 12% in the past 12 months. The correlation (beta 24m) against the Swedish stock exchange is 0.3-0.4 and the volatility amounted to 8.5%, which can be compared with CSRX, which has had just over 19% in total risk during the same period. Returns since inception in 2013 have been strong, with value growth of 155% which compares with the hedge fund index (NHXE) which has risen by 112%.

The long book has returned in line with a relevant market index this year, while the short book has had a certain negative development but still created positive alpha. During the month, however, the long/short spread was negative. The long books most important holdings now are Elekta, SOBI and New Wave.

The short book is dominated by companies where we have identified risks in the accounting or other "red flags" that risk leading to impaired earnings and lower valuation.

The Market

After several years of negative development, China again issued a gigantic stimulus package with the aim of boosting consumption and at the same time reducing indebtedness. The combination of measures has not been seen in 20 years. In addition, further measures are promised in the future to reach the GDP growth target of 5%. The stimulus package gave new energy to both the Asian and international stock markets. The American central bank further chose to lower the key interest rate by as much as 0.5%, which was the first reduction in over four years, and more aggressively than the market had expected. While it may be a signal that the US economy is weaker, we rather assess that this will lead to increased investments at the end of the year and increased confidence in the soft landing scenario.

On the more pessimistic side of the news feed, we note a sharp escalation of the Middle East conflict in recent weeks with rising oil and natural gas prices, higher insurance premiums and more expensive transportation costs as a direct result. It may in the long run become a negative driver of inflation, but it is a bit too early to have a strong opinion.

During the month, there have also been several profit warnings, both globally and in the Nordics. After the pandemic and the problems with the logistics chains, we note that many companies are unsure of what the de facto inventory looks like in their industries when you include wholesalers and other intermediaries. Overall, we assess that inventories have come down but that they are still somewhat high on an aggregated level.

On the stock market, the world index rose by 1.4%. The Nordic region fell by 3.5% and the Nordic small company index rose by 0.1%. September was thus not the shivering month that it has historically been. In the fixed income market, we saw falling government bond yields both globally and in the Nordics.

In the wake of expected and implemented interest rate cuts, risk appetite has increased, which has mainly benefited cyclical companies with high indebtedness. Defensive quality companies have not kept up.

Sector rotations like this usually occur once a year and in the short term there is always a lot of drama, but in the slightly longer term it basically means nothing. What we do know, however, is that it is actually precisely periods like this that, historically speaking, it has been most profitable to invest in our funds. With less than half the stock market risk, Origo has created 9% annual return over 12 years and if we look at the long share book alone, the annual return amounts to +16%. For "value-oriented hedgerow investors", the situation is therefore particularly interesting, based on history.

Where do we find Value, Quality and positive Change?

Throughout 2024, we have put significant analysis resources into the Nordic medical technology sector. The work has continued during the month with a particular focus on radiotherapy.

Radiotherapy is a technology where ionizing radiation is used to treat mainly cancer. Today there are four common ways to treat cancer (drugs, surgery, immunotherapy and radiation therapy) and not infrequently several of the methods are combined. Radiation therapy is one of the most effective methods and has become a mainstay of today's cancer treatment. Globally, over 20 million people receive a cancer diagnosis each year. By 2035, that number is estimated to have grown to 35 million people, so the need for effective care in the future is enormous. (source: WHO)

During the month, we met with the management and principal owners of Elekta, and RaySearch, both of which are medium/large positions in our funds. We have also met with the global leader Siemens/Varian as well as external advisors.

It is quite clear that Elekta has not delivered in accordance with the market's or the company's own expectations. This applies regardless of which line you look at in the income statement. The most obvious problem has been growth, with organic growth around the zero mark recently. Another problem is the weak gross margin of 37%, which given the high-tech focus and strong global position must be seen as a minor disaster.

However, the weak development has been affected by several external factors and specific projects, which makes it easy to miss the underlying quality of the company (Market position, product portfolio, customer base).

Our analysis briefly looks as follows:

Growth:

Sales will pick up going forward when the new product range takes hold in the market. The growth is supported by the fact that hospital budgets, which were squeezed hard by the Covid pandemic, are also heading towards more normal levels. The cancer queues have grown during 2021-2024, but we see several new initiatives, not least in Asia, to reduce the gap. Bottlenecks created in light of China's anti-corruption rules are also slowly dissolving, which could add momentum.

The margins:

We believe that Elekta has developed the best radiation machines based on a patient perspective. This has contributed to Elekta's international success and good reputation among the medical profession, but has probably also affected gross margins negatively as the design and manufacturing processes may not have been state-of-the-art from a profitability perspective.

Inflation has also been extremely troublesome, with increased costs for goods sold on already fixed-price machines. We now see a clear change regarding cost development and cautiously also factor in a gradual improvement regarding the profitability focus in product development.

First profitability – then consolidation?

After Siemens' purchase of Varian in 2020, there has been speculation about what happens next. We expect consolidation in the industry to continue and see the industrial logic of radiotherapy, x-ray and imaging growing together. There are significant synergies within IT development but also when it comes to refining the products and its workflows.

However, we are not interested in receiving a take-over bid at the current valuation level, and we don't think any other owner is either. Elekta's focus in 2025 must be profitability, profitability and...profitability. At the same time, we note that the stock market's confidence in Elekta is at historically low levels, which we find interesting.

We think the underlying quality is underrated now see the light at the end of the tunnel. We have continued to buy shares during the month.

Best,

Team Origo

Better risk/reward in small caps

- Volatile stock markets

- Strong reports from several portfolio companies

- Great potential in MTG

Our funds performed relatively well during a month that was difficult to navigate and generally messy. Origo Seleqt rose by 0.6% during the month, which was approximately 2 percentage points better than the fund's benchmark index. So far this year, Seleqt has returned 18.1%.

The hedge fund Origo Quest rose at the same time by 0.4%. The fund has delivered almost 9% in annual returns since inception and 11.3% in the last 12 months. At the same time, the fund has had a limited net exposure (beta-adjusted) of around 20-25% recently.

August began with a major global stock market correction. A negative development in the American labor market, the geopolitical situation in the Middle East and great nervousness about the valuations of American technology companies contributed to the slide. After a week or so, however, the market began to discount an increased likelihood of a US soft landing rather than recession, which bounced back for the remainder of the month.

Elekta, a larger position in our funds, came out with a Q1 report that was positive. Both sales and the important gross margin beat the market's expectations. However, it kept its "mid-single-growth" forecast for the rest of the year, which perhaps dampened the positive reaction somewhat. We have continued to buy the share as we think the company is still severely undervalued and has good growth prospects when the new product portfolio is gradually introduced in the coming years. We follow the development of the new flagship product EVO, which is in an early stage, extra closely. CE marking has recently been applied for, where permission in the autumn could lead to a sales boom next year.

MTG has been on our radar screen since they sold the esports business in 2022. They were paid well and thus a strong balance sheet and net cash. MTG also sold a smaller part of its mobile gaming business, where the need for investment was greater and the cash flow was negative. The entire sector, except for MTG and a few other companies, has had balance sheet problems, which has pushed valuations down considerably. On top of that, mobile gaming as an industry is still suffering from the effects of the pandemic and a more restrained consumer. Improved demand will result in increased turnover, but will also mean increased marketing costs. However, our view is that the underlying margins in MTG are structurally higher now than a few years ago, which means that we expect a margin expansion when demand turns despite increased market activities.

In the spring of 2024, we started to build up a position in our funds and after a small price development during the summer, the share has now become even cheaper, especially adjusted for the large net cash. We believe that MTG should buy back more shares than has been communicated and that they should take a break from future acquisitions until they have proven that they can scale up both revenue and margins. From current valuation levels, we see strong IRR potential over the next 3-5 years as demand returns to the industry and MTG delivers in line with its ambitions. The Playsimple studio is the clear shining star, but we also see great marginal potential in the Innogames studio. The CEO and board have shown good capital allocation skills since the sale of e-sports, and if they continue with that, we expect the valuation to rise. If that does not happen, the MTG share is an acquisition target as they have strengthened their position but still risk becoming a pawn in a larger game plan when the industry recovers and the M&A window opens.

Another company that came up with an encouraging report was trailer company Freetrailer. "We assess that Freetrailer, with its sharing economy platform, is well positioned to generate profitable and sustainable growth in the coming years," we wrote in the press release in the fall of 2021 after we had acquired a larger stake in the company. At the time, the Danish micro-company had a turnover of around DKK 50 million and had around 600,000 rentals. For the coming year, we expect a turnover of around 130 million and 1.6 million rentals. The stock has risen by more than 80% since our purchase, an increase that is thus driven by significant operational progress.

During the year, Freetrailer launched its new IT platform and a brand new App, which is an important step on the way to becoming the leading micro-mobility platform in Europe. The partnership with IKEA celebrates 20 years this year and together with new customers such as Byggmax, Power and not least Jem & Fix, the continued growth prospects look very promising.

We expect the high August volatility to persist in the second half of the year and assess that small companies have a better risk/reward than large companies in general. This definitely applies to the USA but also to the Nordic countries.

We also want to take the opportunity to tell you a little about what is happening at Origo. Origo Fonder was a bit of a pioneer when we launched the small-cap oriented hedge fund Quest in 2013. In 2022 we followed up with the distinctly alpha-oriented long-only fund Origo Seleqt. Now we take the next step.

I am very happy to now be able to tell you that Origo has recruited the experienced fund manager Per Johansson. Per has an impressive CV with, among other things, 11 years at long-standing Fidelity Investments in London and Boston and several years at the Brummer & Partners-backed hedge fund Bodenholm. The closest comes from Per from D&G where he was a partner. Per has shown that he can create sustainable excess returns regardless of market trends and is sharp when it comes to identifying Special Situations. Per will become a co-owner/partner and together we will form a very experienced small company team with well-documented results on both the long and short side.

We have also hired Oscar Severinsson as new COO. Oscar is a very driven man and with his background as a business developer at ISEC and Head of Fund Operations at Catella Fonder, he will contribute enormously to Origo in the future.

Earlier in the year, we also hired Milo Wahlgren within Operations & Research. Milo has just started the master's program at the Stockholm School of Economics and at the same time works at Origo. Milo is a math pro and has a background as an elite athlete.

Origo Seleqt (Nordic Small Cap)

Origo Seleqt rose by 0.6% during August, which was a couple of percentage points better than the index. In the last 12 months, the increase amounts to 26%. The Danish allergy company ALK-Abello raised its profit forecast once again and the share contributed the most to the fund's return. Freetrailer and Catena also made positive contributions. On the negative side, we find SparNord Bank, which after a longer period of growth bounced back. Net profit in the bank has gone from DKK 900 million to approximately DKK 3 billion in 2024, while the number of shares has decreased by 6%. A huge boost in earnings per share, in other words. We believe that growth will continue, but at a somewhat slower pace.

Origo Quest (Equity L/S) Origo Quest rose by 0.4% during the month which gives 11% on a rolling 12 months and 159% since start. The long book gave a positive return and the short had a neutral development, while the small cap index (VINX Small Cap SEK NI) fell by 1.4%. SOBI accounted for the largest positive contribution. The stock has climbed 18% this year as the market sees the breadth of the product portfolio and that the news flow around the projects has been positive. SOBI is the fund's largest holding (+7% of NAV). Raysearch also had a nice development after presenting another strong report.

Thank you for your trust and support,

Team Origo

Per Johansson and Oscar Severinsson join Origo Fonder

Origo Fonder is pleased to announce the appointment of Per Johansson as the new Co-Chief Investment Officer (Co-CIO). Per brings with him a proven track record of over 20 years in the industry, having consistently delivered top-tier performance in both rising and declining markets. His extensive experience includes serving as a fund manager and analyst at Fidelity in London and Boston for 11 years, as well as founding and acting as Chief Investment Officer (CIO) of the award-winning hedge fund Bodenholm and Boden Capital. Most recently, Per was a Partner at D&G. In addition to his new role, he will become a shareholder in Origo Fonder, starting his new position in September.

Simultaneously, Origo Fonder has appointed Oscar Severinsson as the new Chief Operating Officer (COO). Oscar’s background includes positions at Skandia and Catella Funds, where he served as Head of Fund Operations. Most recently, he was a business developer at ISEC. Throughout his career, Oscar has developed a broad expertise in areas such as fund administration, risk control, compliance, and reporting.

Stefan Roos, Founder and CIO of Origo Fonder, comments:

"Per is a unique stock-picker whom I've been following since he launched the hedge fund Bodenholm. He was undoubtedly our most impressive industry colleague and competitor. I thought then, 'If you

can't beat him, partner with him.' Now, several years later, everything has fallen into place. With Per's recruitment, we are adding an exceptionally skilled manager and analyst to our team. Per has demonstrated an ability to generate long-term alpha regardless of market conditions. Together, I see us as one of the more experienced teams in genuinely active Nordic equity management. We are very pleased to have Per joining the firm both as a partner and manager. Origo has grown over recent years and launched another small-cap strategy, and with Per on board, we are now ready to take the next step together. We are also pleased to welcome Oscar as our new COO. Oscar’s drive and background in data-driven fund administration and regulatory issues will be invaluable as Origo takes its next step forward."

Per Johansson comments:

"I have known Stefan for a long time and have followed Origo's strong performance from the side. The development of the fund over the past 12 years, both in the hedge fund and in the long leg's alpha, I consider to be world-class. When Stefan shared his vision for Origo, I immediately knew I wanted to be a part of it. I am very enthusiastic about Origo’s funds and future, and I believe we complement each other well. Together, we can deliver very good risk-adjusted performance and interesting products for our investors and partners."

About Origo Fonder:

Origo Fonder is an independent fund management company (AIF manager) under the supervision of the Swedish Financial Supervisory Authority since 2012. The team specializes in investing in listed small-cap companies in the Nordic region and manages the multi-award-winning hedge fund ORIGO QUEST, as well as the recently launched focused small-cap fund ORIGO SELEQT. The investment philosophy is based on a pure small/mid-cap focus, with active constructive ownership in sustainable business models. The client base consists of international and Nordic institutions, foundations, and private individuals.

• Origo Quest has a low-beta strategy focusing on absolute returns. Quest has been nominated three times as the best smaller European hedge fund by HFM and has achieved ~9% annual returns since its inception in 2013.

• Origo Seleqt is a long-only fund with high market exposure, distinguished from traditional small-cap funds by being concentrated, genuinely Nordic-focused, and focused on true small-cap companies.

* Please see www.origofonder.se for more information.

Contact: stefan.roos@origofonder.se

Press release PDF

Risk information: Past performance does not guarantee future performance. The value of your investment may rise as well as fall and there is no guarantee you will recover your original investment. An investment in Origo Quest or Origo Seleqt should be seen as a long-term investment.

Rotation into the small cap segment

• Weak macro figures and increased hopes for interest rate cuts

• Interest in small companies continued to increase

• Invested more in undervalued gem

Global equities started strongly but lost momentum during the month, closing at -0.5%. The conflict between Israel and Palestine went wrong, weak economic figures from China and nervousness around the Q2 reports contributed to profit taking. In general, we saw pressure on last year's large-cap winners at the same time as buying interest in the small-cap segment increased. In the US, the Russell 2000 small-cap index rose by 11.1%, while the S&P 500 rose only 0.9%.

The rotation into small caps is the theme of the summer and is primarily driven by hopes for future interest rate cuts combined with relatively attractive valuations. In addition, we see increased M&A activity and that small companies are clear targets in these processes.

The Nordic stock markets went in different directions, but here too, small companies and companies with low valuation multiples ("value companies") had a better development. The Nordic small company index rose 3.8% during the month. The gap with the large companies is still large, with the small company index lagging behind by around 30% in the last two years. We are at the end of the second quarter reporting period and so far the positive deviations are slightly outweighed, but it took a really good report to impress the market.

One of our insights from several company and macro reports is that Germany looks weak. Germany, which has long been dependent on Russian gas, is also the EU's largest exporter to China, with exports twice as high as the EU average. A strong dependence on Russia and China contributes to pressure their industry. Given the relatively high valuation of several industrial companies in the Nordics and their exposure to Germany, this is a risk that we have tried to manage.

Profoto's quarterly report turned out much as we had expected. Turnover increased by 7% to SEK 196m, of which organic growth accounted for the entire rise. Several product launches drove the increase, while the general demand from photo studios and e-commerce customers remained on hold. Profitability weakened and the operating margin fell to 18.5% (25.8), which, however, is still a level that many similar companies can only dream of. Interesting in the report is the CEO's speech, where it is made clear that the company's strong investment in innovation and focus on more product launches is fixed. We expect that these product innovations will begin to be felt in the income statement during Q4 and above all during 2025.

Profoto is a typical Origo company with high gross margins, good cash flow and a leading niche position, while the company is undervalued. A real gem. The stock has been under pressure in 2023/2024 in the wake of high interest rates and tepid consumption, but we believe macro conditions are turning and growth will pick up. We have increased the holdings in our funds during the month.

The service company Coor delivered a worse report. Again, we may unfortunately add. The operating margin of 5.1% and an underlying growth of -1% do not impress. Individual quarters can always be affected by special events, but in Coor's case, the mediocre development has unfortunately been a trend in recent years. Our investment thesis in 2018 was based on a belief that the stable cash flow would generate acquisitions, which in turn would lead to above-GDP growth and rising profitability. We have been wrong in our analysis and have gradually divested our holding during 2023/2024.

Husqvarna (short position in Quest) presented a shaky report where weak weather conditions and generally weak consumption led to sales growth of -6%. The company writes that market conditions are still tough, which is certainly true, but in our analysis we also assume that Husqvarna has structural challenges. We assess that Husqvarna's position with dealers has weakened in the last 3-5 years and that the transition from a petrol-based product range to electric drive is one of the explanations. Too low a percentage of direct sales and rental are other challenges, and in addition, the company seems to have fallen behind when it comes to the new generation of chain-free robotic lawnmowers. We have had a short position on and off in Husqvarna in recent years and the report essentially confirms our thesis.

Our funds have developed strongly over the past 24 months. Origo Quest, our absolute oriented hedge fund has delivered 9.3% while the correlation (Beta 24m) amounts to a moderate 0.45. Quest has been well paid for the company analysis and generated positive returns in both the long and short books. In percentage terms, the short book has actually delivered the best, which is quite interesting given that the market has risen by 20% during the period. The low-beta strategy means that investors get exposure in a fund that is not particularly dependent on the market trend, and that you get an asset whose movements deviate from the rest of the portfolio. The annual return, which since its inception 12 years ago amounts to 8.6%, is created with significantly lower market risk than a traditional equity fund.

Origo Seleqt, our concentrated micro/small company fund has returned 21.6% in the last 24 months, which is in line with the fund's benchmark (VINX Small Cap SEK NI). At the same time, we can state that the fund has performed significantly better than most similar funds and is currently 10-15 percentage points better than the median value of the fund category. The micro/small company segment has developed worse than the large company segment in recent years, and the valuation difference is large. It is our firm opinion that the valuation of the fund's holdings does not reflect a long-term "fair value".

ORIGO QUEST

Origo Quest returned 0.4% for the month, which means 3.4% so far this year and 158% since inception. The long book had a positive development, while the short gave a somewhat negative return. The long/short spread thus became positive. In the long book, it was primarily Freetrailer, Addtech and SparNord that accounted for the largest positive contributions. Addtech delivered a Q2 report well above market expectations, achieving a record margin of 15.3% leading to a 25% gain. Husqvarna fell sharply and contributed positively to the monthly return, while the reverse happened in NCC. During the month, we took the opportunity to increase Alm. Brand, which we financed with increased short sales.

ORIGO SELEQT

Origo Seleqt rose by 1.0% during July. The benchmark index VINX Small Cap rose at the same time by 3.8%. Since the beginning of the year, the return amounts to 17.3%, which is in line with the index. Addlife, SparNord and Freetrailer provided the best return contribution. Europris, VBG and Protector made negative contributions. Alm.Brand recently sold its Energy division and announced that the proceeds will be returned to the shareholders. At the same time, they took the opportunity to raise several of their financial targets. The sale of the energy part is an important piece of the puzzle in our investment case, but the most important thing is that the synergies from the purchase of Codan are realized. During the month, we have, among other things, increased Alm. Brand and sold ATEA

/Team Origo

Strong first half of the year

- Strong half-year - but a mixed stock market

- Elekta below our expectations

- New investment in opportunistic property company

The small companies rebounded after a period of very strong development and the Nordic small company index lost 2.3% during the month, which means an increase of 13.0% since the beginning of the year. Swedish small companies, where the real estate sector weighs heavily, have not kept up with the rest of the Nordic region and are up by 8%.

Recently, the market's enormous focus on inflation and interest rates has decreased somewhat and we see signs that the companies' fundamental development has become an important factor. This suggests that the "small company revenge" since March will continue. It should not be forgotten that the small companies, which deliver better profit growth over time, underperformed on the stock market in 2021, 2022 and 2023. Four years of underperformance relative to the large companies is historically extremely unusual.

Elekta (-19% YTD) came up with a weak quarterly report during the month. Both organic growth and margins were lower than expected and also lower than what the company had guided for before the report. After five straight quarters of improvement, management says the quarter was challenging with a number of installations taking longer than planned which had a negative impact on revenue and profit. We do not know if it is some installations that are the real problem, but rather see opportunities for improvement in terms of governance and internal follow-up. Elekta operates in an attractive growth market and now has a modern and strong product portfolio including the recently launched AI-powered EVOaccelerator. Despite that, Elekta has so far had inexplicably difficulty in raising profitability.

The management's ambition is to lift the gross margin of 37% to the levels before the pandemic, when it was 42%. We believe that the potential is clearly higher than that and really see no reason why Elekta's margin should be up to 10 percentage points (our assessment) lower than the main competitor Variance. The management must now show that you can get a return on all the investments you have made in the last five years and that efficiency is increasing. In addition, there are good opportunities for the important Chinese market to gain momentum and for the new and strategically important collaboration with GE Healthcare to start yielding returns. We expect earnings growth of around 30% for this year and next while the stock is valued at 12X operating earnings. Good risk/reward in a high-tech growth company with a strong global market position.

Spar Nord Bank rose 8% during the month (+25% YTD) after once again raising its earnings forecast. Our investment thesis almost three years ago was based on the fact that we saw a good opportunity for significant distribution of capital to the shareholders given the company's strong balance sheet and good credit quality. We note that the company's development fully follows our plan. We expect rising returns on capital again this year, a new internal IRB model for calculating how much capital the bank must hold to cover its risks and high dividends and buybacks.

SLP, Swedish Logistic Property, is a new holding in our funds. The company's strategy is to acquire and develop logistics properties primarily in southern Sweden. The company is relatively new (2018 and listed on the stock market in 2022) but has already demonstrated a good ability to make value-creating purchases of properties in a niche that we have followed closely since our investments in Tribona and Catena about 10 years ago. The Q1 report was strong and earnings (CEPS) rose to 0.43 (0.38) driven by higher rents and improved net financials. We think the stock is undervalued and that "small is beautiful" in a capital-intensive industry that is coming back to life after the inflation and interest rate shock of 2022-2023. It will be particularly interesting to follow the sector's development going forward. We see several global signals (destocking is in its final phase, manufacturing is moving home, new investments in infrastructure, the energy transition is accelerating, the inflation problem is soon a thing of the past) that may play out so that the manufacturing industry and cyclical consumer goods receive support.

The division of the stock market, as it has looked in the last 4-5 years, may then be close to the end of the road.

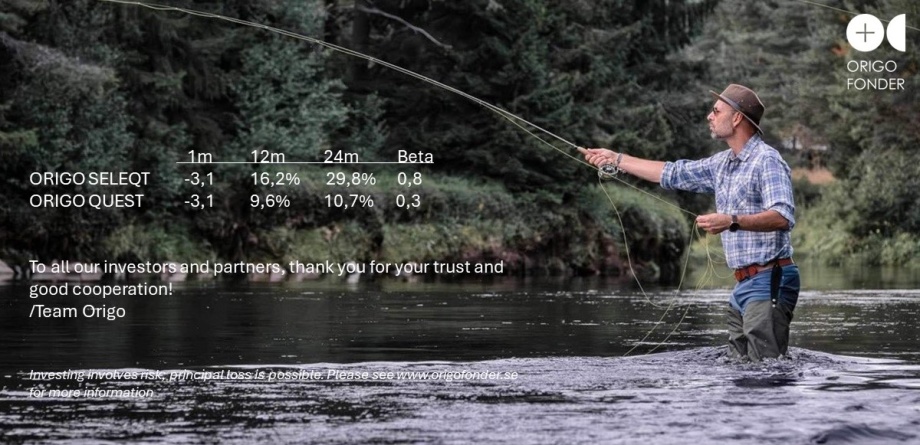

ORIGO QUEST

Origo Quest lost 3.1% in June, giving 3.0% YTD and 9.6% on a rolling 12 month basis. The long book had a weak development (eg Elekta) while the short book (eg RVRC) gave a positive return. The long/short spread was overall negative. Since the start, the return amounts to 157%, which corresponds to 8.6% per year.

The fund is positioned to have low correlation to the stock market and 24m Beta amounts to 0.3. The net exposure amounted to 55%. MTG, Elekta and RaySearch are major long-term investments during the year. The card book is currently focused around companies with significant accounting, value creation and valuation risks.

ORIGO SELEQT

Origo Seleqt lost 3.1% in June after the strong rise in March-May. The return during the first half of the year was thus 16.2%, just over 3 percentage points better than the benchmark index. Elekta accounted for a large part of the negative deviation during the month. The software company BIMobject, a smaller holding in the fund contributed well after a positive analysis in the newspaper Affärsvärlden.

The fund is concentrated and currently consists of of roughly 30 real small caps, where the majority have a market cap between SEK 500 million and SEK 20 million. Elekta, New Wave and MTG are the fund's largest investments during the year. Nekkar and Trifork have been sold.

We also want to take the opportunity to thank all our investors for your trust and good cooperation during the first half of the year and wish you a really nice summer!

/Team Origo

Positive signals

- Small Caps have taken over the baton

- Significant potential in the Nordic health care sector

- ORIGO SELEQT rose by 7.0% and ORIGO QUEST by 4.1%

2024 has started strongly in the world's stock markets and May was no exception. The world index rose by 3.8% and the Nordics by 1.6%. Small caps, which have underperformed for three years up to March this year, were winners again with a rise of 5.6%. The strength of this year's rise is interesting, given that at the same time we have seen rising long-term interest rates, which normally reduces risk appetite on the stock market. Not many believed in that combination six months ago.

We interpret it as the stock market has begun to focus increasingly on growth, both regarding the world economy and listed companies. In the US, consumption is holding up better than expected, as so many times in the past in periods of economic turmoil. In China, the government seems to be accelerating with stimulus, which should have positive effects on global growth, and in Sweden, the Swedish Riksbank chose to run ahead of both the FED and the ECB and lowered the key interest rate during the month.

In the last year, we have been "chattering" that we think the risk/reward relationship is positive when we leave an environment where growth is revised down and inflation is high to a macro environment characterized more by better growth and lower key interest rates. We stand by that view and think the valuation of small and medium-sized companies is clearly attractive.

Vaisala, the Finnish weather technology company we own, received a mega order for 18 radar stations for Spain's meteorological agency. The value of the order was EUR 25 million, the largest order ever for Vaisala. The contract also provides service revenue during 2024-2026. An increased need in the world to predict extreme weather events will be a value driver for Vaisala for many years to come. The other business area of Vaisala, Industrial Measurement (IM) is a bit more cyclical and has yet to take off. We still raise our forecasts and see great potential in the share going forward. The weather part will grow nicely and IM, which has higher profitability, will probably pick up at the end of the year. The company is a leader in a structurally growing niche, has a net cash position, delivers a ROCE of over 22% in a weak industrial economy and is valued at 15X earnings in 2025. We have increased the holding during the month.

In February, we built up a medium-sized position in Raysearch Laboratories when the share traded below SEK 100. In mid-May, when the share stood at SEK 130 and expectations were at a completely different level, the company came out with its Q1 report. The report was very solid with an organic growth of 11% but what impressed the most was the cost control and cash flow.

Our investment thesis is that the company has left a long and partly heavy investment period behind and has recently turned the strategy towards profitability. The three main products are completely out on the market and priority one now is to increase sales volumes. The client list is impressive and we note that some leading hospitals have taken in Raysearch's software solutions at the expense of competitor Varians. The report demonstrates the scalability and confirms our optimistic analysis.

Our Norwegian-Swedish service company Norva24, on the other hand, delivered a slightly sad report for the first quarter. The currency-adjusted organic growth was 1.6% and the operating profit fell by 12%. Behind the relatively weak numbers, however, we see that they have been affected quite a bit by fewer working days in this quarter compared to last year. The management also writes in the report that if you look at the first four months, the trend has instead continued to be positive. We also note that five companies have already been bought this year, which was the number we expected for the whole year. The M&A strategy is convincing and the industry is still deeply fragmented.

We have met with many companies recently and are in the process of putting together the puzzle for the second half of the year and 2025 and the question we ask ourselves is; Where do we find undervalued quality companies and where are they in terms of timing on the stock exchange? For a very long time, at least the last ten years, we have been very impressed by the Nordic health care sector including all the niches that are nearby. The problem is that it has been hyped on the stock market and the valuations have required completely unrealistic growth forecasts.

During the pandemic, hospitals generally pulled the handbrake and many companies had problems, which together with a general stock market decline caused many stocks to collapse. This segment is now one of our favorite areas and we have built up a very exciting position (Raysearch is an example) with 6–7 fast-growing Nordic small and medium-sized companies with a focus on both pharmaceuticals and medical technology.

At the time of writing, we are also doing the same major mapping within another sector that we estimate will grow significantly more than GDP in the next five years. More on this work in future reports!

ORIGO SELEQT

Origo Seleqt rose by 7.0% during the month and has thus risen by 20.5% in the last 12 months. Nolato, ALK-Abello and Vaisala made strong contributions to returns. Bakkafrost had a negative impact at the same time. The portfolio essentially consists of high-quality companies with good profitability and strong balance sheets, but which we also judge to be undervalued and in several cases misunderstood. The beta against the benchmark amounts to 0.8 since the start. We have continued to increase in areas such as medical technology and software and have started to build up a couple of new holdings. The purchases have been financed with sales in, among others, ATEA.

ORIGO QUEST

ORIGO QUEST rose 4.1% in May and is up 15.6% in the last 12 months and 165% since inception. The long book rose clearly more than the short book, so the quality of returns was high. Raysearch, New Wave and Freetrailer made good contributions among the fund's long positions. In the short book, two holdings within the Daily Goods group contributed positively, while Basic Industry had a slightly negative impact. The net exposure amounted to 36% and the volatility over the last 12 months was 8.9%. The corresponding volatility figure for the small cap index (CSRX) is 19.0%. Since its inception in 2013, the fund has returned 9.0% annually. During the month, we continued to increase in medical technology. Greetings Team Origo

/Team Origo

The Nordics shows strength

Market comment

The global growth statistics have continued to surprise on the upside and in most markets the decline in inflation continues at the same time. The exception is the United States, where the rate of price increase is higher than expected. The market's interpretation is, however, that there is room for interest rate cuts in Europe going forward, which is an assessment that we share.

The reporting season is in full swing and at the time of writing we can state that profits have exceeded forecasts while sales have come in lower than expected. It is too early to draw any major conclusions, but the fact that turnover is weak does not feel particularly surprising given where we are in the business cycle. More surprising is that the Nordic gains are holding up so well, and for Sweden specifically, it is even more interesting as the forecasts, unlike the USA and the rest of the Nordics, have been adjusted up for the reporting period.

The world index fell by 3.4%, while the Nordic stock markets had a more neutral development. The small companies (VINX Small Cap SEK NI) on the other hand rose at the same time by 0.3%. So far this year, cyclically stable sectors such as health care and consumer goods have performed the strongest, while interest-sensitive construction and property stocks are at the bottom.

ORIGO QUEST (Equity L/S)

The fund's development and focus

Origo Quest lost -0.9% during the month. In the last six months, the fund has risen by 12.3% and since the start the return amounts to 154.9%, which corresponds to 8.7% per year. The long/short spread was negative during the month given a weak development in the long book, where mainly New Wave and Hanza cost. The short book produced a slightly positive result for the month, as well as YTD.

Munter's Q1 report was solid, with both order intake and profit margins surprising the market on the upside. Revenue grew organically by 7% (11% in total), driven by, among other things, the Datacenters business area. Order intake was even more impressive with an increase of 32% for the group. Parts of the sell-side analyst groupn have been skeptical of Munter's margin targets for the past year, but have been too cautious so far and we are now seeing upward revisions to the profit forecasts for 2024 and 2025.

We further assess that the company's successful transformation continues and believe that software, sensors and control systems will play an even more important role in the future.

The fund is positioned for some upside but with a belief that the high volatility will continue to be high. The focus is on creating additional returns and limiting market risk. The fund's volatility amounts to 9.6%, which can be compared to the small cap index of 24.6%

ORIGO SELEQT (Nordic Smal Cap)

The fund's development and focus

Origo Seleqt rose by 2.1% during April. The increase in the last six months amounts to 29.0%, approximately 3 percentage points better than the Nordic small company market.

Medicover, Freetrailer and Nolato contributed positively, while Hanza, Europris and New Wave negatively affected the monthly return.

One of the fund's best investments last year, with a share rise of over 80%, is Danish NKT. The company, which is one of the world's leading companies in high-voltage cables, has invested heavily in recent years and is now reaping the success of this. NKT benefits from the strong electrification trend and has become a winner when new energy systems are to be connected to old electricity grids. NKT, which was actually the first company that

Origo invested in after the launch of the Origo Quest fund in 2013, delivered a whopping 36% organic growth and a new record for operating profit in 2023, and the future prospects are still bright. For example, NKT recently signed an order of 40 billion to a German company to be able to carry out an energy transition.

The market capitalization has swelled and after the valuation to a P/E of over 20X for next year - on a record profit - we see, however, that the risk from here has increased. We have therefore taken home part of the profit to finance new investments.

So far this year, we see big differences in the price development on the Nordic stock exchanges and at sector level. The pattern from last year seems to be repeating itself. The Danish stock exchange has climbed over 15%, while the Finnish harrows around the zero mark. Banking and finance have led the rise so far, while real estate and above all energy have had a hard time keeping up.

At Origo, companies are not chosen based on a country och sector strategy, but on company-specific risk/reward. However, we can state that the funds currently have a clear bias towards consumer discretionary.

After the pandemic-doped super demand in 2021, large stocks of, for example, leisure products and other capital goods were built up at distributors and stores. When it then turned out that that demand was not realistic, there was a "stop" in new sales for many companies and the valuation multiples fell dramatically. We believe that the first half of 2024 marks a bottom in the inventory cycle for most of the companies in the sector.

Another favorite sector right now is Healthcare. Stable underlying demand, in several cases clear signs of normalization after pandemic-related disturbances, as well as historically low valuations are some of our arguments

So far this year, several of the funds' largest new investments have taken place within this group of companies (Elekta, Raysearch, Alk-Abello etc.)

/Team Origo

Market comment

Optimism characterized March, as a result of falling inflation and the fact that more and more investors perceive the economic development as more predictable.

Global stocks rose 3.2% during the month. The Nordic small cap index (Vinx Small Cap SEK NI) advanced by 6.6%, while the Swedish microcap index (CMCRXSE) rose 5.6%.

ORIGO QUEST (Equity L/S)

Origo Quest rose by 3.5%, which means a new all-time high for the fund. The long book outperformed the market after strong performance for Catena, AOJ, Coor and Wihlborgs, among others. The short book and other positions had a mixed development. The return for the last six months amounts to 10.5%, while risk-taking corresponds to approximately one third of the stock market's risk level.

The volatility amounts to 9%, which can be compared with the small company index which is 24%.

Nolato is a new holding that we feel is both under-analyzed and misunderstood. We invested after the price decline in connection with the financial statements in February this year. In Nolato, it's the margin that rubs off.

The Integrated Solutions business area has more or less undergone an implosion in the wake of changing customer behavior and sharply falling VHP volumes.

The hub of the movement is the medical technology division, Medical, which accounts for the majority of the revenue base. Even in that business area, margins have been under pressure following rising commodity prices, a lag in price adjustments and jerky order placement in surgery. The major acquisition of American GW Plastic has – so far – not been a major success, but instead brought with it a diluting margin effect driven by, among other things, high labor costs.

However, there is great potential for improvement in the group. Recently, Nolato announced a significant cooperation agreement with a global pharmaceutical giant - by implication Novo Nordisk - regarding supplies of medical devices to administer drugs against obesity and diabetes. At full production, the collaboration is expected to bring in annual revenue of around SEK 700m. Nolato stock, which has traded weakly for the past 3 years, is in need of a positive trigger, something that is now here with the GLP-1 hype next year.

The Danish insurance company Alm. Brand, founded back in 1792, is also a new long holding in the fund. After the sale of the life company and the acquisition of Codan, the new company has established a strong position on the Danish non-life insurance market. We expect significant synergistic effects, driven by increased outsourcing, digitization and automation, as well as continued pure farming. The stock has risen by +20% in the past six months, but the upside is significantly greater than that, while we assess that both the operational risk and the valuation risk are relatively low.

The fund's largest long-term holding, the service and car company Bilia, made a major acquisition at the beginning of the month through the purchase of the family company Olofsson Bil. Through the purchase, Bilia adds SEK 1.3 billion in revenue and, fully in line with our investment thesis, continues to consolidate the car market in Sweden. The stock has risen by almost 30% in the last six months, but is nevertheless valued well below comparable service companies. We believe that the gap will close in the coming years as the recession risks subside and the stock market's view of the company's business model changes.

ORIGO SELEQT (Nordic Small Cap)

ORIGO SELEQT increased 6.8% during the month. The real estate company Catena and the winter tourism company Skistar made major positive contributions to the fund's development. Negative contributions came primarily from the larger holdings in Hanza and Medicover.

During the fall of 2023, we participated in Skistar's capital market day. At the time, we were surprised by the low interest in the company, where only a few institutional investors participated on site. The share traded close to the 100 kroner level and shortly afterwards we started to build a position in the company. Skistar recently delivered a record quarter and is a top holding in ORIGO SELEQT.

Under the leadership of CEO Stefan Sjöstrand, Skistar has implemented a series of operational improvements. Like other seasonal businesses, the majority of profit and cash flow is generated during a limited time of the year. Weather and wind can get in the way, but this year all the stars have aligned. A snowy, cold winter combined with a positive calendar effect (with Easter in Q1) has benefited the group. In addition, interest in sustainable tourism in the local area is growing.

In addition to the winter season, there is great potential in the summer investment. Break-even is some year away in the summer half, but would provide significant change on the bottom line. After a price rise of around +50% since the entry, the Skistar share is more reasonably valued. It is possible to reason about what a correct valuation is for a unique asset company with a monopoly-like position in the growing northern part of Sweden. For the time being, exploitation profits are lying fallow, but provide another growth cylinder once the economic and interest rate curve improves.

Nolato is another holding that we feel is both under-analyzed and misunderstood. The share was bought in after the price decline in connection with the financial statements in February this year. Since then, the holding has been built on and, like Skistar, is a larger holding in the fund. In Nolato, it's the margin that rubs off. The Integrated Solutions business area has more or less undergone an implosion in the wake of changing customer behavior and sharply falling VHP volumes.

The hub of the movement is the medical technology division, Medical, which accounts for the majority of the revenue base. Even in that business area, margins have been under pressure following rising commodity prices, a lag in price adjustments and jerky order placement in surgery. The major acquisition of American GW Plastic has – so far – not been a major success, but instead brought with it a diluting margin effect driven by, among other things, high labor costs.

However, there is great potential for improvement in the group. Recently, Nolato announced a significant cooperation agreement with a global pharmaceutical giant - by implication Novo Nordisk - regarding supplies of medical devices to administer drugs against obesity and diabetes. At full production, the collaboration is expected to bring in annual revenue of around SEK 700m. Nolato stock, which has traded weakly for the past 3 years, is in need of a positive trigger, something that is now here with the GLP-1 hype next year.

/Team Origo

Market comment

Global stocks continued up a whopping 4.5% during the month, led by US technology companies, but despite a strong stock market month, we noted a lot of conflicting movements. At the same time that the semiconductor company Nvidia came out with a super report that was followed by a new all-time-high, long-term yields in the US rose by almost 0.3% points and generally the defensive segment of the stock market was the relative winner. The Nordic stock exchanges were traded more like the global index ex. US tech. The Nordic small cap index (Vinx Small Cap SEK NI) rose by 1.4% and the Carnegie Micro Cap index fell by 1%.

ORIGO QUEST (Equity L/S)

The return during the month amounted to -0.8%. The return in the last six months amounts to 7% and to 149% since the start. The long portfolio rose slightly and the short increased, giving a positive long-short spread. The hedge, on the other hand, contributed negatively. At company level, positive contributions came from the long holdings New Wave, Munters and Freetrailer, while SOBI had a negative impact.

At the end of the month, our Danish micro cap Freetrailer presented a really encouraging report that showed solid growth on all lines. Turnover grew by 42% and earnings per share increased sharply. The number of rented trailers grew by 35% during the quarter, which was a new record. We are impressed by the momentum the new management has created and also note that they raised their growth forecast for the full year. The stock rose significantly after the report and is up 24% so far this year.

In previous years, from time to time, we have had a short position in the Swedish medical technology company Elekta. For several years, the company has had noticeable difficulty in raising profitability to a sensible level. We have gradually changed our view on the company over the winter and have now take n a long position.

The basis of our analysis is that we unfortunately see a constant increase in the world's need for radiotherapy against cancer. We expect the need to generate global growth of around 6% per year and double that for emerging markets. The market is dominated by two suppliers; Varian and Elekta, which together have around 90% market share. We see it as highly unlikely that Elekta will not be able to take part in the market growth.

The pandemic created many problems for the industry with fewer cancer treatments, and smaller hospital budgets than planned, which ate into Elekta's margins. In addition, inflation took off, which created a negative cost effect on the large order book that had already been built up. As if that wasn't enough, China introduced new anti-corruption rules last year, which caused several hospitals to hold off on their purchases.

We now expect that the pandemic and inflation problems will subside and that the turnaround will come within the next 1–2 quarters. We further believe that the new precision radiation therapy system Unity, which has a higher proportion of software and service, will contribute to the margin lift and that the stock market is underestimating Elekta's potential going forward in China.

ORIGO SELEQT (Nordic Small Cap)

ORIGO SELEQT fell 2.0% during the month. The pharmaceutical company ALK-Abelló, the salmon company Bakkafrost and the sharing service Freetrailer made major positive contributions to the fund's development. Negative contributions came primarily from the holdings in Medicover, Hanza and Norva24.

After a strong January, several larger holdings developed weakly during February, which negatively affected the fund's return. Medicover fell sharply on its Q4 report, which we find unjustified. The outlook is stronger than in a long time, while Q1 2024 will be the first quarter without major clinic openings and covid-related revenues in the comparison base. Profit growth is expected to accelerate in 2024, when already expanded care capacity is filled with a high incremental margin. During the month, we acted on the weak price trend and increased the position.

At the end of February, Norva24 came out with its financial statements. During October and November, the trend from Q3 continued with high organic growth and rising margins. Then came the month of December, which brought the coldest and snowiest weather in 25 years. As operations are largely carried out outdoors, activity was negatively affected in several departments, especially in Norway.

Working outdoors - with water - at minus 25 degrees is for obvious reasons challenging, which was also visible in the cross rivet. The margin in Q4 was disappointing for both us and management. However, weather and wind cannot be controlled and the weather-related "post out" could just as well have become a "post in" if December had been milder, such as winter 2020/2021.

Despite the weather situation, organic growth amounted to +5% for Norva24 during the fourth quarter compared to the same period last year. At a time when most serial acquirers lose one or more percent organically, the level of growth demonstrates the strength of the cyclically stable business model that Norva24 has. A short-term and backward-looking market, chose to trade the stock down sharply after the Q4 report.

Looking ahead, the outlook remains bright. Although the month of January has been affected by similar weather to December, higher temperatures are imminent in the spring. With the extreme cold experienced during the winter, another, deeper, type of frost also comes in the ground. When this pipe goes out of the ground, the aging pipe infrastructure will be greatly affected. In addition to frost damage, all snow is expected to melt. The risk of burst pipes, floods and water leaks is high during the spring, which is expected to increase demand for Norva24's services.

M&A activity has been muted recently, driven by the CEO change in September 2023. The new CEO Henrik Norrbom is now in place and the company has several ongoing DD processes. Cash flow has improved sequentially and the balance sheet has strengthened, which means that we expect a substantial ramp-up in the number of M&A transactions in the next 6–12 months. Overall, the investment thesis is followed despite the margin disappointment in Q4. Norva24 is the largest holding in ORIGO SELEQT.

/Team Origo

Strong month in a volatile market

January started more cautiously compared to the turn-of-the-year optimism that marked December 2023. Repositioning and profit-taking resulted in relatively sharp jumps between different sectors and asset classes during the start of the new year. The market has continued to focus heavily on incoming inflation data and how the world's central banks are expected to act in 2024. Speculation about when the first interest rate cut will become a reality has been rife. Most indications are that the first interest rate cut is approaching, whether it will be late spring or summer remains to be seen.

At the time of writing, reporting season is in full swing. Last year was clearly macro- and flow-driven, but our expectation is that 2024 will bring more focus on micro factors and how the various companies are coping in an environment of falling demand, softer economic conditions and geopolitical unrest. Our analysis is that resilient business models will be rewarded during the year, especially if you can demonstrate organic growth and margin stability. The Stockholm Stock Exchange (OMXSGI) lost momentum and fell 1.6% in January. The Swedish small cap index (CSRX) also retreated 2.4%, while the Nordic small cap (VINX Small Cap) fared better and advanced, albeit modestly, by 0.5%.

ORIGO QUEST

The return for the month amounted to 0.3%, which means 7% last year and 9% in annual average return during the almost 11 years that the fund has existed. On an aggregated level, we saw rather small changes within the portfolio during the month. The long book rose slightly during the month with the short book falling slightly, meaning that the long/short spread produced a positive result. Derivatives on indices contributed slightly negatively. Three investments stood out positively, of which two were long holdings: SOBI and A&O Johansen and a short position in the gaming sector. On the negative side during the month we find a long holding; Bilia.

The salmon sector was under pressure following the news that the European Commission is investigating whether six salmon farmers may have breached EU competition rules, based on inspections in 2019. One of the named farmers, MOWI, was quick to respond with a sharp response that they were convinced that any breaches had not happened. QUEST previously had investments in Norwegian salmon, but since last autumn the fund's position consists of the Faroese company Bakkafrost. Our initial assessment is that the commission's analysis may be flawed, but that it involves a clear uncertainty factor and may become a wet blanket over the sector. Our holding Bakkafrost, on the other hand, can be a relative winner In the long term, Nordic stocks and US stocks have followed each other quite well, but now we see clear bubble risks in the US tech sector at the same time that Nordic small and medium-sized companies are valued below their historical average. In our opinion, the Nordic stock market is very attractive with many companies that are at the forefront of structural trends such as automation, the environment and energy.

However, we started the new year by increasing the short side of the fund. After the strong share appreciation during Q423 where several leading indices rose by 10-15%, and with increased geopolitical tensions, as well as an impending and highly uncertain quarterly report season, we chose to take several new short positions and increase the short book in total. When we take short equity positions, it is not only "broken business models" that we are looking for, but we also include companies that we judge will underperform against the market.

ORIGO SELEQT

SELEQT rose 4.9% during the month. The positive development was broad-based in the fund, where several holdings contributed to the positive development. Trifork, Norva24 and Medicover made positive contributions to the fund's development. Negative contributions came primarily from the holdings in TGS, Hanza and Vaisala.

The holdings in SELEQT are clearly different from both indexes and similar funds. The portfolio is exposed to companies with strong business models, often focused on service, maintenance and sales of consumables. During the past year, sectors such as industrial services and health care have been weighted up, where we find businesses that can maintain growth even in a weaker economy. At the end of January, the Norwegian insurance company Protector Forsikring presented its financial statements. As usual, the company pleasantly surprised again. Growth continues, with premiums increasing 48 percent in local currency in the fourth quarter. At the same time as the combined ratio landed at 86.4% in Q4 2023, driven by both good cost control and an improved claim rate. The shareholder-friendly policy is clear in Protector, where the company has returned significant amounts to the owners in the form of cash dividends, often on a quarterly basis, in recent years. The stock has developed strongly and has been included in ORIGO SELEQT since the fund's launch in March 2022.

Among the month's losers, the Norwegian energy data company TGS stands out with a clear negative contribution. TGS came out with a surprisingly weak trading update in January, where the - seasonally strong - Q4 showed weaker development than expected. The explanation can be found partly in lower energy prices, but mainly in the fact that larger energy companies focus on M&A rather than investing in organic growth. It's nothing new, but a trend that has been evident lately and reinforced with major transactions among players such as Exxon, Chevron, etc. Following the merger with industry peer PGS, TGS has the premier library of energy data in the world. The TGS share is in the valley of disappointment, but trades on low multiples given conservative synergy estimates and a normalization of the pace of investment going forward.

/Team Origo