ORIGO QUEST

Equity long/short with focus on quality small- and mid caps in transition

ORIGO QUEST is an actively managed equity long/short fund focused on mispriced securities and absolute returns in the Nordic small- and mid cap space. The fund takes both long and short positions with the aim of limiting the fund's dependence on the market's underlying trend and to create competitive risk-adjusted returns.

The management is based on the Origo model, a structured analysis process with a focus on sustainability, change and long-term value creation.

The managers strive to create absolute returns over time through a good stock selection and to manage the fund's net exposure to the stock market well over time.

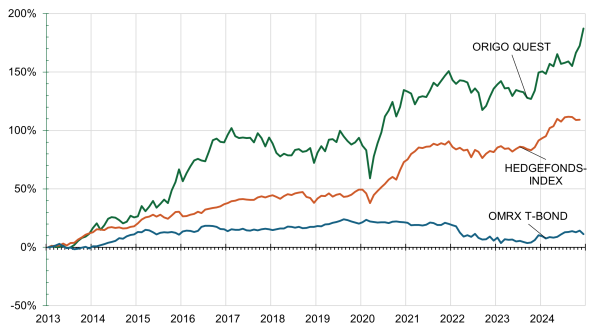

Historical returns 31/12/2024

| 2024 | START | |

| Quest A | 15,1% | 187,4% |

| Equity hedge Fund Index (NHXE) | 9,4% | 93,5% |

| OMRX T-Bill 90 | 3,6% | 1,3% |

| OMX Stockholm | 8,8% | 284,4% |

| S&P Europe | 7,3% | 87,8% |

Key Ratios 24m

| Quest A | OMXS | |

| Yearly return | 10,4% | 13,7% |

| Risk-adjusted returns (Treynor) | 32,5% | 13,7% |

| Risk-adjusted returns (Sharpe) | 1,13 | 1,05 |

| Beta vs OMX Stockholm | 0,3 | 1,0 |

| Volatility 24m | 9,2% | 13,1% |

Origo Quest 2013-2024

2024: Top 3 in Europe

Latest NAV(external link)

Why ORIGO QUEST?

- Portfolio diversification (less correlated to equity and fixed income markets)

- Excess returns (Quest has a long/short strategy and rely less on upwards markets, as there is a potential for returns from both rising and falling pricis)

- A multi-award winning fund management team with +40 years of combined small cap experience

- Use at the core of your alternative portfolio to seek competitive risk-adjusted growth

Fund Documents

18/12/23: New fund regulations for Quest (Swe)

KIID/ Fact sheet

Information Brochure

Subscription/ redemption Form

Risk Information

Past performance is not a guarantee of future returns. If you invest in funds, your investment can both increase and decrease in value and it is not certain that you will get back the entire invested capital. An investment in ORIGO QUEST should be seen as a long-term investment.