Monthly Update - June

Strong first half of the year

- Strong half-year - but a mixed stock market

- Elekta below our expectations

- New investment in opportunistic property company

The small companies rebounded after a period of very strong development and the Nordic small company index lost 2.3% during the month, which means an increase of 13.0% since the beginning of the year. Swedish small companies, where the real estate sector weighs heavily, have not kept up with the rest of the Nordic region and are up by 8%.

Recently, the market's enormous focus on inflation and interest rates has decreased somewhat and we see signs that the companies' fundamental development has become an important factor. This suggests that the "small company revenge" since March will continue. It should not be forgotten that the small companies, which deliver better profit growth over time, underperformed on the stock market in 2021, 2022 and 2023. Four years of underperformance relative to the large companies is historically extremely unusual.

Elekta (-19% YTD) came up with a weak quarterly report during the month. Both organic growth and margins were lower than expected and also lower than what the company had guided for before the report. After five straight quarters of improvement, management says the quarter was challenging with a number of installations taking longer than planned which had a negative impact on revenue and profit. We do not know if it is some installations that are the real problem, but rather see opportunities for improvement in terms of governance and internal follow-up. Elekta operates in an attractive growth market and now has a modern and strong product portfolio including the recently launched AI-powered EVOaccelerator. Despite that, Elekta has so far had inexplicably difficulty in raising profitability.

The management's ambition is to lift the gross margin of 37% to the levels before the pandemic, when it was 42%. We believe that the potential is clearly higher than that and really see no reason why Elekta's margin should be up to 10 percentage points (our assessment) lower than the main competitor Variance. The management must now show that you can get a return on all the investments you have made in the last five years and that efficiency is increasing. In addition, there are good opportunities for the important Chinese market to gain momentum and for the new and strategically important collaboration with GE Healthcare to start yielding returns. We expect earnings growth of around 30% for this year and next while the stock is valued at 12X operating earnings. Good risk/reward in a high-tech growth company with a strong global market position.

Spar Nord Bank rose 8% during the month (+25% YTD) after once again raising its earnings forecast. Our investment thesis almost three years ago was based on the fact that we saw a good opportunity for significant distribution of capital to the shareholders given the company's strong balance sheet and good credit quality. We note that the company's development fully follows our plan. We expect rising returns on capital again this year, a new internal IRB model for calculating how much capital the bank must hold to cover its risks and high dividends and buybacks.

SLP, Swedish Logistic Property, is a new holding in our funds. The company's strategy is to acquire and develop logistics properties primarily in southern Sweden. The company is relatively new (2018 and listed on the stock market in 2022) but has already demonstrated a good ability to make value-creating purchases of properties in a niche that we have followed closely since our investments in Tribona and Catena about 10 years ago. The Q1 report was strong and earnings (CEPS) rose to 0.43 (0.38) driven by higher rents and improved net financials. We think the stock is undervalued and that "small is beautiful" in a capital-intensive industry that is coming back to life after the inflation and interest rate shock of 2022-2023. It will be particularly interesting to follow the sector's development going forward. We see several global signals (destocking is in its final phase, manufacturing is moving home, new investments in infrastructure, the energy transition is accelerating, the inflation problem is soon a thing of the past) that may play out so that the manufacturing industry and cyclical consumer goods receive support.

The division of the stock market, as it has looked in the last 4-5 years, may then be close to the end of the road.

ORIGO QUEST

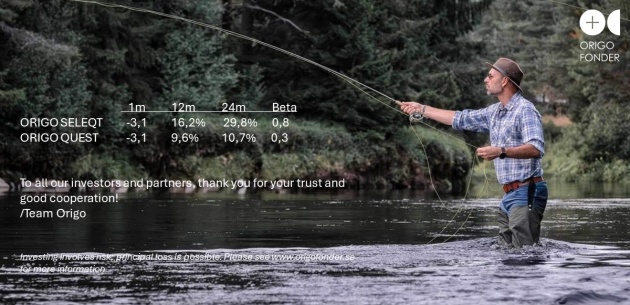

Origo Quest lost 3.1% in June, giving 3.0% YTD and 9.6% on a rolling 12 month basis. The long book had a weak development (eg Elekta) while the short book (eg RVRC) gave a positive return. The long/short spread was overall negative. Since the start, the return amounts to 157%, which corresponds to 8.6% per year.

The fund is positioned to have low correlation to the stock market and 24m Beta amounts to 0.3. The net exposure amounted to 55%. MTG, Elekta and RaySearch are major long-term investments during the year. The card book is currently focused around companies with significant accounting, value creation and valuation risks.

ORIGO SELEQT

Origo Seleqt lost 3.1% in June after the strong rise in March-May. The return during the first half of the year was thus 16.2%, just over 3 percentage points better than the benchmark index. Elekta accounted for a large part of the negative deviation during the month. The software company BIMobject, a smaller holding in the fund contributed well after a positive analysis in the newspaper Affärsvärlden.

The fund is concentrated and currently consists of of roughly 30 real small caps, where the majority have a market cap between SEK 500 million and SEK 20 million. Elekta, New Wave and MTG are the fund's largest investments during the year. Nekkar and Trifork have been sold.

We also want to take the opportunity to thank all our investors for your trust and good cooperation during the first half of the year and wish you a really nice summer!

/Team Origo